Cross-Border Payments: The Financial Bridge of Global Trade

Cross-border payments have become the lifeblood of the global economy. According to FCX Intelligence, Global payments are projected to surge, escalating from USD 190 trillion in 2023 to an impressive USD 290 trillion by 2030. This article will discuss its essence, challenges and impact on Global Trade.

The Essence of Cross-Border Payments

Cross-border payments are transactions involving the movement of funds between individuals, businesses, or financial institutions located in different countries. Such payments are essential for a variety of reasons:

Facilitating International Trade

Cross-border payments are the lifeblood of international trade. Businesses rely on these transactions to pay for imported goods, services, or raw materials from overseas suppliers. Similarly, exporters receive payments from foreign buyers, allowing them to tap into new markets and expand their customer base.

Supporting Global Supply Chains

In today's intricate supply chains, components and products often traverse multiple borders before reaching their destination. Cross-border payments enable seamless financial transactions between the various entities involved in these supply chains, ensuring smooth operations and timely deliveries.

Driving Economic Growth

Efficient cross-border payment systems contribute to economic growth and encourage investment opportunities, foster innovation, and enhance market access for businesses, thereby boosting economic development worldwide. To support this, a recent statistics from Statista shows (B2B) cross-border payments are forecasted to surpass $39 trillion in 2023 and are anticipated to reach $56 trillion by 2030.

Challenges Hindering Cross-Border Payments

Despite their undeniable importance, cross-border payments face several challenges:

Challenge #1 High Costs and Fees

Traditional cross-border payment systems are often burdened by high transaction fees, foreign exchange costs, and intermediary charges. These fees can significantly reduce the amount received by the beneficiary, impacting businesses' profitability.

Challenge #2 Lengthy Processing Time

Cross-border payments may take several days or even weeks to complete due to the involvement of multiple intermediary banks and clearing systems. Lengthy processing times can cause delays in transactions, disrupting business operations and cash flow.

Challenge #3 Regulatory and Compliance Hurdles

Different countries have diverse regulatory frameworks and compliance requirements, making cross-border transactions complex. Compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations adds layers of complexity and may hinder the speed of transactions.

The Impact of Inefficient Cross-Border Payments on Businesses

1. Increased Costs and Reduced Profitability

Businesses that engage in international transactions often face high transaction costs associated with cross-border payments. These costs can include currency conversion fees, intermediary fees, and bank charges, which can significantly erode profits, particularly for small and medium-sized enterprises (SMEs).

2. Strained Supplier Relationships and Supply Chain Disruptions

Inefficient cross-border payments can strain relationships with suppliers and disrupt supply chains. Delays in payments can lead to misunderstandings, late deliveries, and potential loss of suppliers, impacting a business's production and customer satisfaction.

3. Reduced Competitiveness and Global Market Share

In a globalized economy, businesses compete on a global scale. Inefficient cross-border payments can place businesses at a disadvantage compared to competitors who benefit from faster, cheaper, and more transparent payment systems.

4. Increased Administrative Burden and Operational Costs

Businesses must dedicate time and resources to managing complex cross-border payment processes, adding to administrative burdens and operational costs. This can divert resources from core business activities and limit efficiency.

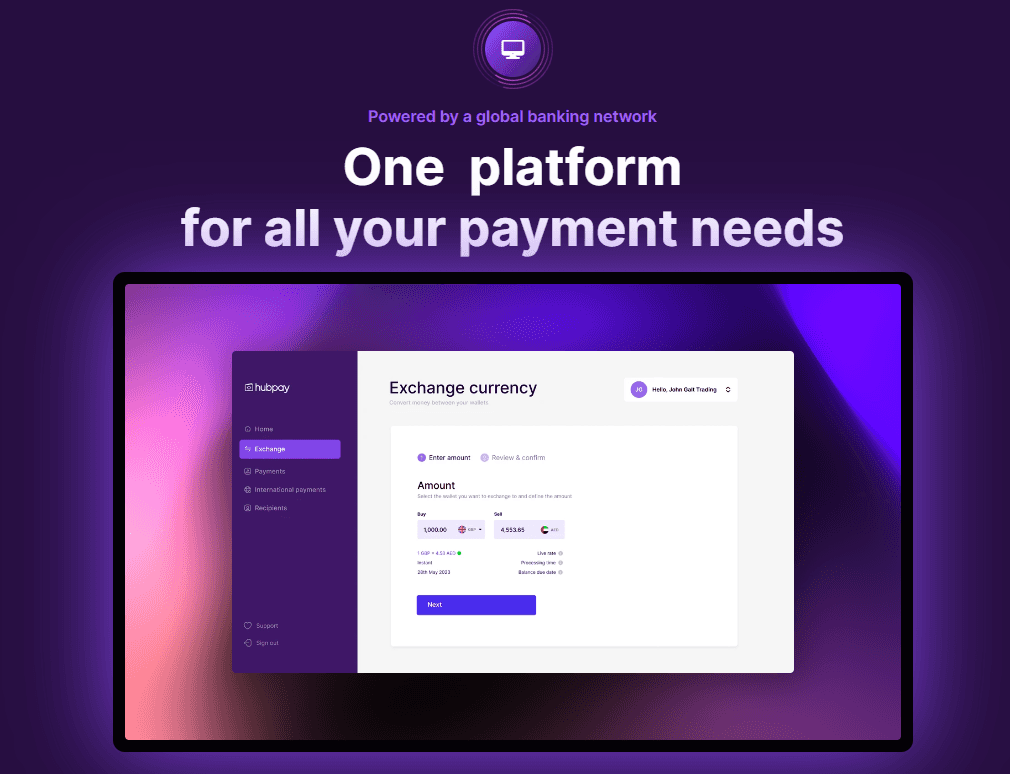

Navigating the Cross-Border Payment Landscape with Hubpay Corporate Suite

In the face of the challenges posed by traditional cross-border payment systems, Hubpay Corporate Suite offers a streamlined and cost-effective solution for businesses of all sizes with a suite of features designed to meet the needs of today's global businesses.

Conclusion

Cross-border payments play a crucial role in facilitating international trade, supporting global supply chains, and driving economic growth. However, traditional cross-border payment systems are often plagued by high costs, lengthy processing times, and regulatory hurdles, which can significantly impact businesses. Hubpay Corporate Suite emerges as a game-changer, offering a streamlined and cost-effective solution that addresses the challenges of cross-border payments, enabling businesses to navigate the global marketplace with greater efficiency and profitability.